Tax Relief Act 2024 Summary Notes – Tax Notes contributing editor Robert Goulder discusses the downward attribution dispute in Altria Group Inc. v. United States and the case’s similarities to Moore. . By Adam Hardy MONEY RESEARCH COLLECTIVE This year, the IRS is partnering with eight companies that will offer tax prep and e-filed returns to those eligible. Money; Getty Images As the 2024 tax season .

Tax Relief Act 2024 Summary Notes

Source : www.investopedia.com

Publication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.gov

Federal Solar Tax Credits for Businesses | Department of Energy

Source : www.energy.gov

Brian Sullivan on X: “New Ivy league study finds “Inflation

Source : twitter.com

The Bluebook: A Summary of Key Tax Topics for 2024 | FORVIS

Source : www.forvis.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Jen Coleslaw on X: “oh also this one. https://t.co/ICSK6ewTUi” / X

Source : mobile.twitter.com

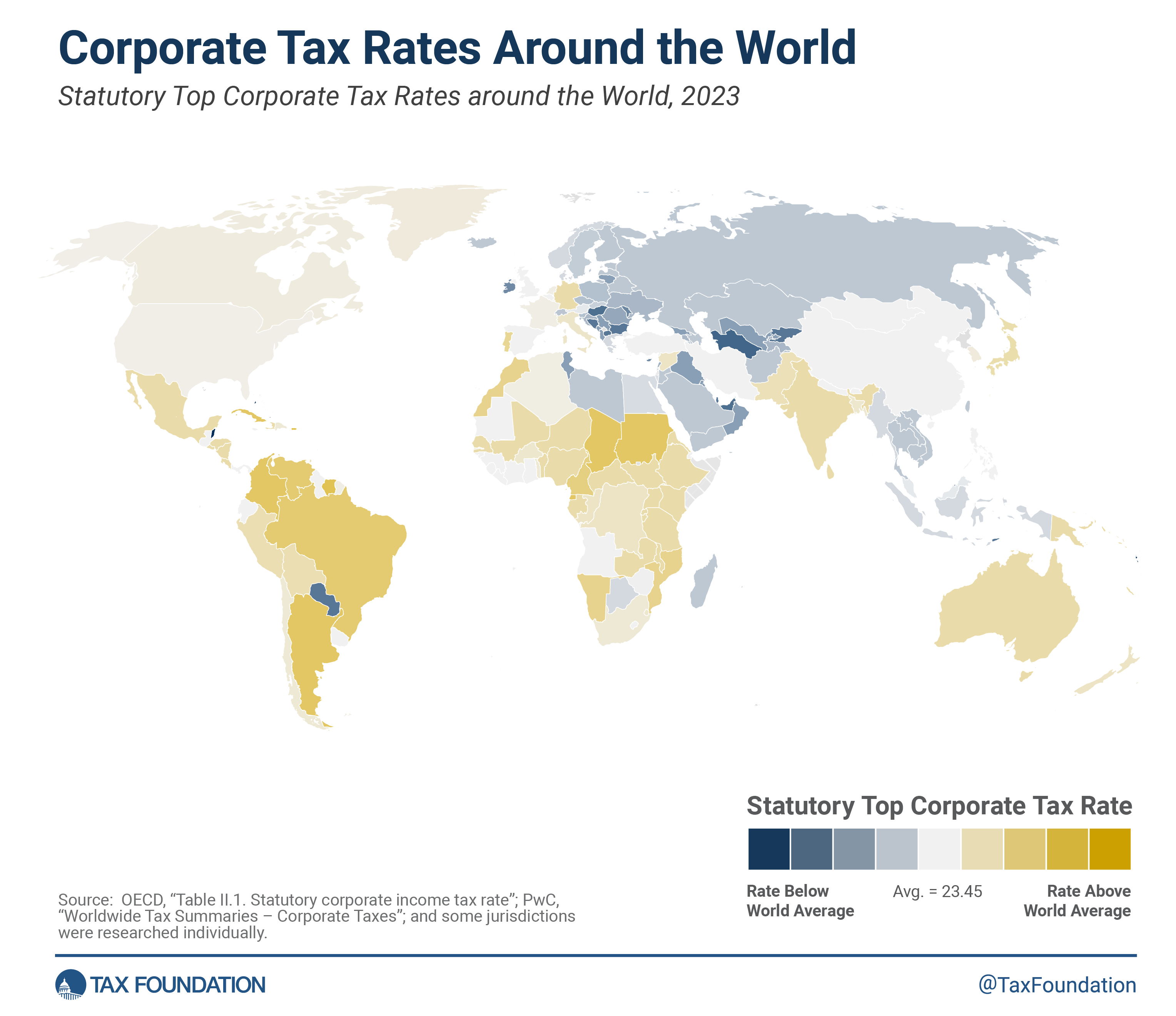

Corporate Tax Rates around the World, 2023

Source : taxfoundation.org

Tax Legislation Announced by Tax writing Chairs Wyden and Smith

Source : www.novoco.com

2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org

Tax Relief Act 2024 Summary Notes Tax Deduction Definition: Standard or Itemized?: The Inflation Reduction Act made significant changes to the kinds of tax credits on Jan. 1, 2024, cars from the 2022 model year will be eligible. Consumer Reports notes that only model year . Freedom Debt Relief Best for tax debt: CuraDebt Best for customer satisfaction: Pacific Debt Relief New Era Debt Solutions stands out in several of the categories we considered. The company has .

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)